Ronald Goseco l September 13, 2024 l The Manila Times

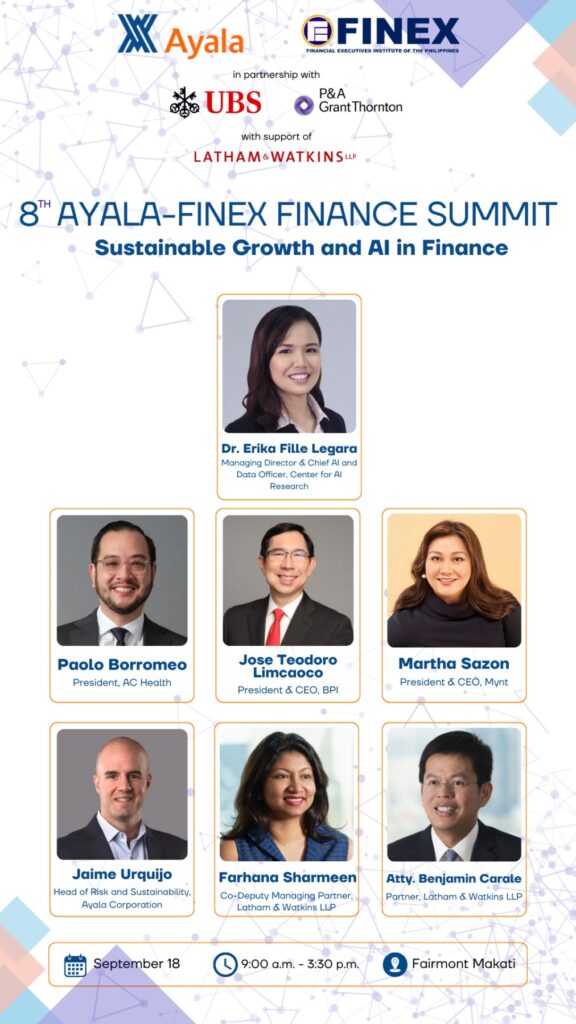

THE 8th Ayala-Finex Finance Summit is scheduled on September 18 in Makati, with the theme “Sustainable Growth and AI in Finance.”

Sustaining growth has been difficult for many firms because of the volatility and increased risks in the global economy. Technology solutions and artificial intelligence (AI) can assist in the development of new products and services to address the problems.

AI adoption in the country is also expected to boost the economy by $30 billion, according to research by the Department of Trade and Industry (DTI). But the shortage of AI-equipped talent in our information technology (IT) and Business Processing Management (BPM) sectors remains a challenge. These problems and possible solutions will be addressed at the summit.

We have invited Dr. Erika Fille Legara as keynote speaker. She will talk about the Philippine AI National Strategy Roadmap, which the DTI has launched. This program aims to position the Philippines as a center of excellence in AI research and development (R&D).

The goal envisions the transformation of the Philippines into an AI hub within the Asean region, focusing on boosting the economy and improving quality of life. It includes strategic actions to harness AI’s potential in various sectors, such as sustainable agriculture, urban planning and disaster resilience.

The roadmap established the Center for AI Research which Dr. Legara heads. It aims to promote socioeconomic R&D, improve specific knowledge, and ensure responsible AI adoption, including the necessary ethical guide rails. This strategy seeks to leverage AI to address societal and industrial challenges, stimulate economic growth, and promote inclusive development in the country.

Also invited to speak are Ayala Health President Paolo Borromeo, Bank of the Philippine Islands (BPI) CEO Jose Teodoro Limcaoco, Mynt President Martha Sazon, and Ayala Head of Risk and Sustainability Jaime Urquijo. The first three speakers will share some of the AI use cases they have implemented in their respective firms.

In health care, global use cases include diagnosis and treatment planning with AI algorithms for image recognition in X-rays or MRIs, predictive analysis for disease risks for cancer and heart diseases, as well as natural language processing (NLP) for interpreting clinical notes.

Other use cases in global health care include personalized medicine involving AI-driven genomics for customized treatment plans and machine learning for predicting patient responses to specific drugs.

Administrative automation is now widely used globally for scheduling as well as claims processing and coding automation. Virtual assistants for patient monitoring and support are also gaining widespread adoption in other countries.

Remote monitoring and telemedicine now use AI tools for analyzing data from wearable devices. Chatbots are being used for preliminary diagnostics and symptom assessment in many countries.

Improving patient engagement is also key in the health care business, and this is where virtual health coaches for wellness management and AI platforms come in to provide personalized patient care.

Fraud detection

Some of the use cases in banking and financial technology include fraud detection and cybersecurity, which use AI for detecting unusual patterns or anomalies in transactions and access. Behavioral biometrics are now being used to enhance security measures. Customer experience enhancements use 24/7 virtual customer support.

A new development is the capability of AI to analyze sentiments to understand customer feedback. In risk management, AI models are used for credit assessment and predictive analytics to assess market risks and trends. There are now alternate data analysis services in the country that use social media or phone account histories to improve credit scoring.

To enhance operational efficiency, the back office is being automated to enable document processing, data entry and handling of customer inquiries.

I am certain all of us have experienced being assisted by telephone bots. AI-driven predictive maintenance for IT infrastructure is also being used to enhance productivity since these are interconnected.

There are also AI tools for providing personalized financial planning and advisory services for wealth management. Many banks have adopted intelligent automated loan approval workflows, as well as machine learning for accurate underwriting and risk assessment.

We’ve also seen AI applied to personalized financial services that provide insights and push customized product offerings.

Other issues to be tackled at the summit are the sustainability challenges we face as companies and as a nation. These include environmental and governance concerns.

Clearly, the utilization of AI has great potential to promote efficiency, accuracy and creativity in businesses. This summit will help leaders navigate through the technology conundrum to succeed in driving sustainable growth.

Ronald S. Goseco is a trustee of the Financial Executives Institute of the Philippines (Finex) Foundation. His opinions are his own.