Dr. Conchita L. Manabat l August 21, 2024 l Business Mirror

“Wealth isn’t always measured in dollar signs.

We each have time, talent and creativity,

all of which can be powerful forces for positive change.

Share your blessings in whatever form they come

and to whatever level you have been blessed.”

—Jon M. Huntsman

WEALTH in terms of money, investments, real estate, works of art, jewelries, other assets and stature are the usual gauge of success in business. What does one derive from doing things that impact others in immeasurable way where no measurable return in terms of profit, compensation or any form of asset is gained? Two words seem to fit: Psychic Income.

Psychic Income is not scalable. It can neither be spent nor saved/invested. To those who have done their fair share in sharing knowledge and experience as well as resources with no expectations on returns/payments, there is that feeling of “getting high” or a different kind of happiness – unique and almost beyond description.

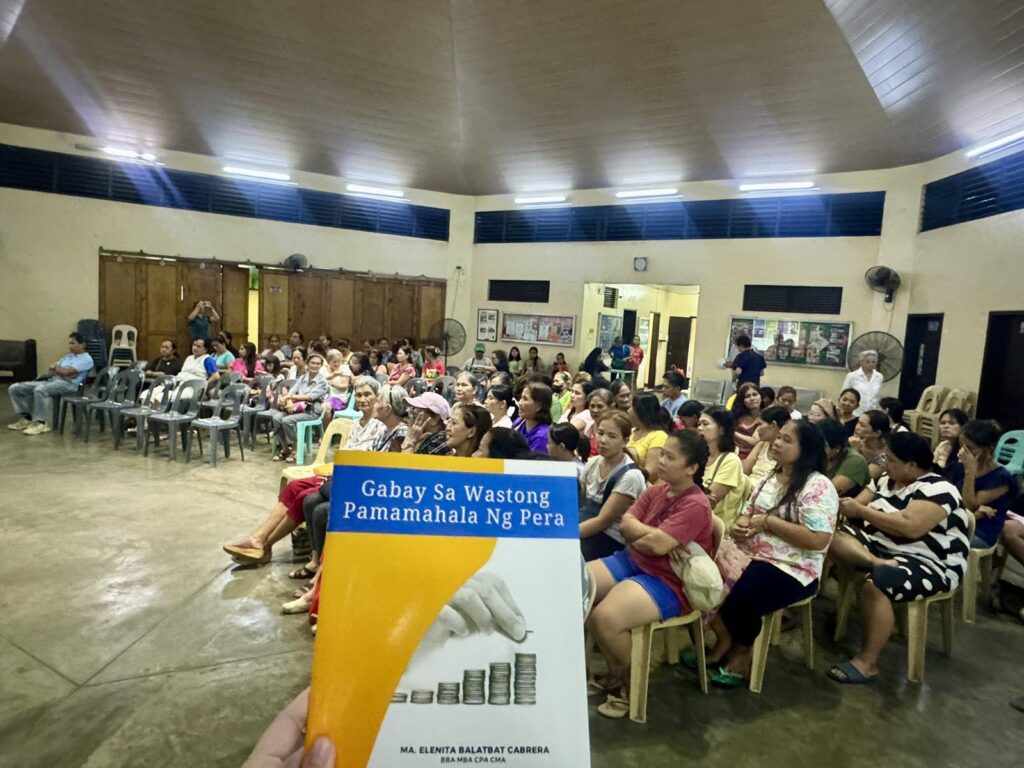

The continuing advocacy of the Finex Foundation through its Social Involvement Committee, now in its 9th year, has yielded unique enrichment among those who have unselfishly contributed their resources, knowledge and experience in rolling out basic financial literacy among the growing beneficiaries. Modules include concepts in personal finance anchored on the importance of family, communications and education, simple recordkeeping and basics of entrepreneurship.

To complement the sharing of knowledge and experience are the discussions on caselettes featuring simplified real-life situations that are commonly encountered. All module sessions are delivered in Pilipino for ease of understanding. A “Handbook on Personal Finance” (English and Tagalog versions) serves as reference to interested members of our society.

The beneficiaries of the program include—the informal settlers along the railway and Pasig river relocated at “Bayan ni Juan” some nine years ago in partnership with Children’s Hour Foundation; those from Payatas in partnership with the Consuelo “Chito” Madrigal Foundation; mothers, fisherfolks and farmers in partnership with Ahon Sa Hirap (ASHI) Foundation; micro-business owners and those financially challenged communities in partnership with Tulay sa Pag-unlad (TSPI) Foundation; men and women in uniform in partnership with the Philippine National Police and the Armed Forces of the Philippines; Muslim communities in Quezon City; parents of scholars at Saint Theresa’s College; retired military men and women in Baler; constituencies of the Diocese of Paranaque; parents/guardians of the challenged children under the care of the Servants of Charity; members and beneficiaries of the Coalition of Services for the Elderly (COSE), members and beneficiaries of Unang Hakbang Foundation; retiring personnel of a winding down energy eompany; and more. As of July 2024, more than 110 seminars/webinars catering to more than 7,000 beneficiaries were conducted. More seminars/webinars translating to more beneficiaries are lined up for the year and the years to come.

Those who design, prepare and deliver the seminars/webinars are volunteers. They are the selfless members of the Financial Executives Institute of the Philippines (Finex), all experienced professionals.

There is absolutely no monetary return in delivering basic financial literacy modules on voluntary basis. The consequential impact on the lives of participants—the youth, the elderly, the underprivileged, the service men and women of the military, those poised to retire and others is immeasurable. Those who share their expertise and the beneficiaries learn from each other.

Every interaction is a rewarding encounter. Legacy is a consequence.

“We make a living by what we get.

We make a life by what we give.”

—Winston Churchill

*** Conchita L. Manabat is the president of the Development Center for Finance and a trustee at the University of San Carlos, Cebu City. She is a member of the Stakeholders Advisory Council for IAASB & IESBA and chairs the Advisory Council of the International Association of Financial Executives Institutes.

The views and opinions expressed above are those of the author and do not necessarily represent the views of the Financial Executives Institute of the Philippines and the BusinessMirror.