Benel D. Lagua l 16 August 2024 l BusinessWorld

In the finance world, there is no better Batman and Robin tandem than Warren Buffet and Charlie Munger. Munger was the vice-chairman of Berkshire Hathaway, the multinational conglomerate controlled by Buffet. He is credited to have played a pivotal role in Buffet’s success through his intellectual influence, strategic thinking and ethical leadership. His approach to life and business makes him a timeless role model for anyone.

Munger passed away on Nov. 28, 2023, a little short of his 100th birthday. Buffet described Munger as the “architect of Berkshire”. “In terms of having a partner, I simply cannot think of a conversation I had with Charlie that he misled me … In terms of managing money, there wasn’t anybody better in the world to talk to for many, many decades than Charlie.”

Before partnering with Munger, Buffett primarily focused on a strategy influence by Benjamin Graham, which emphasized buying undervalued companies at a discount, often referred to as “cigar-butt investing”. Munger encouraged Buffett to adopt a more holistic approach that considered the quality of a business and its long-term potential for growth, even if it meant paying a fair price for an outstanding company. This shift led to investments in companies like Coca-Cola, American Express, and Apple, which have yielded significant returns.

Munger introduced Buffett to the concept of “economic moats” which are competitive advantages that protect a business from competitors. By focusing on companies with strong brand recognition, efficient operations, and unique products or services, Munger helped Buffett identify investments that would provide sustainable, long-term growth. This led to building Berkshire Hathaway’s diverse portfolio of successful companies.

Charlie Munger studied mathematics in the University of Michigan. Interestingly, he dropped out of college to serve in the U.S. Army. Still, he took up meteorology at the California Institute of Technology and other advanced courses through several universities. When he applied at the Harvard Law School, he was initially rejected because of the absence of an undergraduate degree. A former dean intervened, and he got in, graduating with a J.D., magna cum laude.

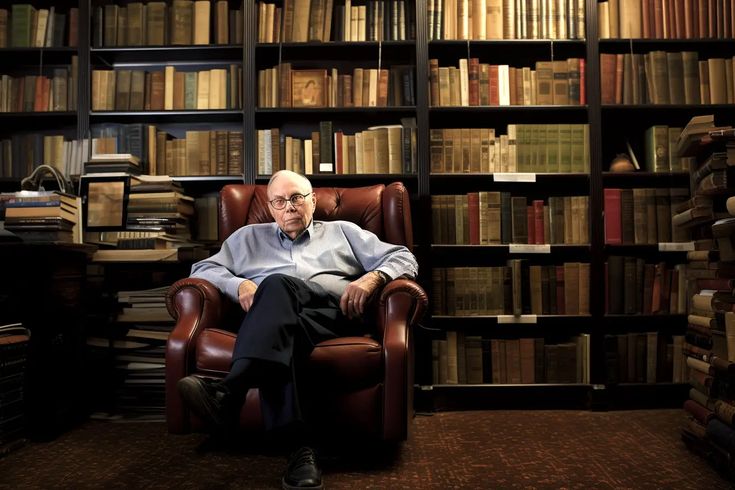

His varied interests reflect an unwavering commitment to lifelong learning. A voracious reader and thinker, Munger advocates a multidisciplinary approach to knowledge, famously promoting the concept of “worldly wisdom.” He believes that one must have mental models from various disciplines such as psychology, economics, history, and physics to make sound decisions. Munger’s intellectual curiosity and dedication to understanding complex systems highlight the importance of education and continuous learning. He believes that expertise in one field is often not enough; understanding and integrating knowledge from diverse areas is essential to solve problems and make informed decisions.

He is famous for his inversion philosophy, some advice to “invert, always invert” when solving problems. This means always considering potential downsides in any decisions or solving problems by addressing the issues backwards. This is a disciplined approach to avoid common pitfalls, especially in business and investment decisions.

Integrity is another cornerstone of Charlie Munger’s philosophy. He has consistently stressed the importance of honesty and ethical behavior in business. Munger’s adherence to high ethical standards has earned him immense respect in the business community. He believes that reputation is invaluable and that one should always act in a manner that enhances and protects it. In a world where short-term gains often tempt individuals to compromise on values, Munger’s unwavering commitment to integrity demonstrates how principled behavior can lead to long-term success and respect.

Munger’s life also exemplifies the power of resilience and perseverance. He faced significant personal challenges, including the loss of his son to leukemia and a battle with cancer. He lost his left eye in his 50’s. Despite these hardships, Munger demonstrated remarkable resilience, channeling his energy into his work and personal growth. His ability to overcome adversity and maintain focus on his goals is inspirational, illustrating that challenges can be transformed into opportunities for growth and learning.

Furthermore, Munger is an advocate of simplicity and frugality. Munger lived in the same relatively modest California home for 70 years. He believes in living within one’s means and avoiding unnecessary extravagance. This mindset aligns with his philosophy of focusing on what truly matters. Munger’s emphasis on simplicity prioritizes long-term objectives over short-term pleasures with wise allocation of resources.

Charlie Munger’s partnership with Warren Buffett highlights the importance of collaboration and humility. Despite his remarkable intellect and accomplishments, Munger recognizes the value of working with others and appreciates the strengths that different perspectives bring. His relationship with Buffett demonstrates the power of mutual respect and a willingness to challenge each other’s ideas. Buffett calls Munger “part older brother, part loving father.”

Berkshire Hathaway’s unprecedented success is largely due to the tremendous support of Charlie Munger to Warren Buffett. Thus, Charlie Munger stands as a remarkable role model due to his dedication to lifelong learning, critical thinking, integrity, resilience, simplicity and collaboration. His principles and philosophies, his wisdom and integrity offer timeless lessons that extend beyond the realm of investing and business. Through these values, individuals can aspire to lead lives characterized by success, fulfillment, and ethical conduct.

===

Benel Dela Paz Lagua was previously EVP and Chief Development Officer at the Development Bank of the Philippines. He is an active FINEX member and an advocate of risk-based lending for SMEs. Today, he is independent director in progressive banks and in some NGOs.

The views expressed herein are his own and does not necessarily reflect the opinion of his office as well as FINEX. (Photo from Pinterest)