RONALD GOSECO l May 10, 2024 l The Manila Times

FINEX invited Prof. Ronald Mendoza, PhD to speak at its Fourth General Membership Meeting last April. He spoke about the economic implications of a brewing Cold War between China and the United States. He compared this with the first Cold War between the US and Russia. He pointed out that although the analogy between the first and second one is limited.

It is important to understand the potential risks, as well as the economic opportunities to navigate through this new global economic, security and technological landscape. He predicted that the economic aftershocks borne by the increasing frictions between these two countries will generate global repercussions due to the sheer size, level of integration and technological leadership of these two nations.

He also pointed out to the multipolar geopolitical and economic landscape, which is composed of a large number of middle powers around the globe, some of whom have nuclear capabilities, which could affect global peace and progress. The risks have also intensified with the wars taking place in Europe and the Middle East.

Mendoza fascinated Finex with data ranging from the large bodies of water that comprise the Philippine archipelago and the vast resources that we could be extracting from these waters. Another piece of information that we barely talk about is the fact that the Chinese economy now stands as the largest in the world after overtaking the US in 2017 in terms of GDP-PPP. This is the gross domestic product (GDP) based on purchasing power parity (PPP). This takes into account the difference in the cost of living and purchasing power between countries. Clearly, it is cheaper to live in China than the US. This development is bothering US politicians.

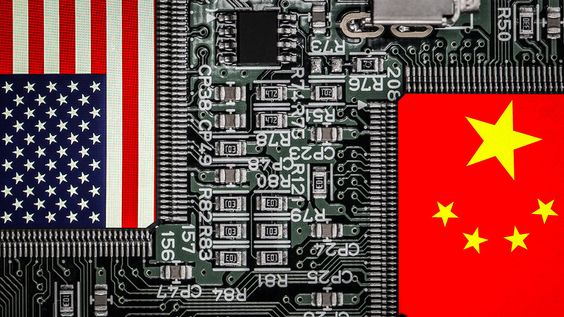

Because of this, Mendoza expects increased tensions, not simply touching on national security issues but also in terms of increased economic competition. We have to be mindful though that these two nations are inextricably linked in terms of their supply chains. The economic interdependence between these countries is a complex relationship, particularly in the pharmaceutical and semiconductor industries, as well as rare earth minerals. Over the recent year, the trade of pharmaceutical products between them has seen significant growth.

The US imports a substantial amount of pharmaceuticals from China including advanced medicines for cancer and antibiotics. This reliance is not one-sided as China has also become a major consumer of US-manufactured pharmaceuticals reflecting a balanced trade dynamic. One could say that both of them are dependent on the other. The semiconductor industry is another area where both countries are deeply interconnected.

Although the US has historically been a leader in innovation and production, China’s rapid advancement in this sector has likewise created interdependencies between them. Rare Earth minerals are also a vulnerable necessity. These are essential for the production of a wide array of high-tech devices, military equipment and critical for energy transition, particularly for the production of batteries and solar panels.

China without doubt dominates this industry, and the entire world is dependent on China. It will take a while to develop mines, smelters and refineries elsewhere in the world for these minerals which are aptly named. This inextricable link between these two countries is a delicate balance of cooperation and contention, specially in these three industries, which are all vital to the achievement of prosperity and security of all nations.

Mendoza concluded that there are indeed opportunities for countries like ourselves in this environment. He described “friend shoring” as one of them. Many companies are trying to reduce their dependencies on the Chinese production mills. We need to attract them to our shores.

To attract these investments, we need to strengthen our political governance in the midst of what Mendoza described as a growing populist wave and democratic retreat that seriously threaten and undermine democratic governance not just in our country but for many others as well. On top of these political shocks are the technological shocks.

It is therefore important for nations such as ours to steer and diversify alliances, maintain strong independence and strive for economic, political and technological progress. The way Mendoza pictured it, the path to progress is not linear, but we need to strive as a nation for these ideals in order to gain a respected seat in the coming global order which is definitely coming.

*** Ronald Goseco is a Finex Foundation trustee. His opinions are his own.

The views and opinions expressed above are those of the author and do not necessarily represent the views of FINEX. Photo from Pinterest.