Benel D. Lagua l April 12, 2024 l Business World

Banks are designed to allocate capital to business and consumers efficiently. This is done by managing the risk of transforming short-term debt into long-term loans. However, the financial crisis of 2007 revealed unbridled credit extension and wealth destruction. Consequently, we saw massive failure in the banking industry.

Because of this, regulations have doubled up on financial institutions. Banks were required to hold higher levels of quality capital to absorb potential losses and mitigate risks. The liquidity of banks’ balance sheets is being regulated more intensely. Metrics on various facets of bank operations are now regularly monitored. Stricter capital requirements, liquidity standards, risk management guidelines, and stress tests rules were imposed.

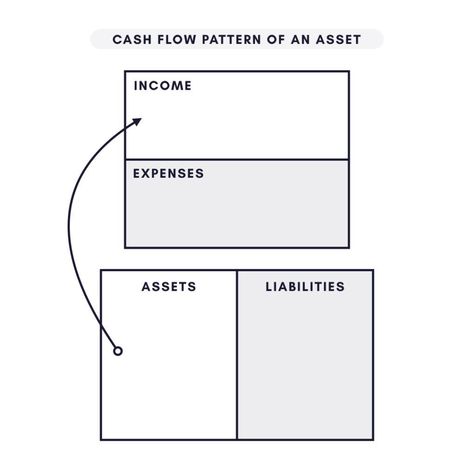

A key tool used by financial institutions to manage their financial risk is Asset Liability Management

(ALM). It is a mechanism to address the risk faced by a bank due to mismatch between assets and liabilities either due to liquidity or change in interest rates. By maintaining equilibrium between assets and liabilities, financial institutions ensure ample liquidity to fulfill obligations and simultaneously invest in assets that yield long-term productivity.

Today, ALM is a required discipline for banks. It aims to manage the volume, mix, maturity rate sensitivity, quality and liquidity of assets and liabilities to attain predetermined acceptable risk/reward ratios. The overall goal is to stabilize short-term profits, long-term earnings, and long-term substance of the bank. Banks use real time information system to review the maturity matching of assets and liabilities across various time horizons.

A good ALM system reviews the interconnectedness of several basic risk categories. Liquidity risk pertains to the potential risks in meeting current and future cash flow commitments. Interest rate risk encompasses the uncertainties stemming from fluctuations in interest rates and their impact on forthcoming cash flows. Deposit and loan products are primarily vulnerable and fluctuations in market interest rates can lead to imbalance between assets and liabilities.

Credit risk management involves assessing and reducing risks in lending activities to address potential losses. The aim is to ensure well-informed decision making by lenders. The bank must satisfy a specified reserve position in relation to expected losses out of the loaned amounts. Operational risk management imposes robust internal controls. The bank is required to implement sound corporate governance practices that ensures compliance to regulatory standards. The integrity, efficiency and resilience of an organization’s operations must be safeguarded.

While ALM is traditionally associated with banks and financial institutions, its principles and methodologies can also be applied to nonfinance firms to enhance strategic decision making, manage risk and optimize resource allocation. Firms should monitor and manage risks associated with mismatches between the company’s assets and liabilities.

Nonfinance firms can use ALM principle to strategically allocate their resources, such as capital, human resources, and physical assets, in alignment with their long-term goals and objectives. Just like banks, these firms face various risks, including market risk, liquidity risk, interest rate risk, credit risk, and operational risk. The company should identify, measure, monitor and mitigate these risks effectively.

By analyzing the timing and magnitude of cash inflows and outflows, firms can ensure its liquidity position meets operational needs and financial obligations. This involves managing working capital efficiently, forecasting cash flows accurately, and providing adequate liquidity buffers.

Nonfinance firms can adopt ALM principles related to long term planning and forecasting, including developing a financial model and doing scenario analysis that incorporate macroeconomic factors, including trends and business uncertainties. The idea is to make informed business decisions and to be flexible in adapting to changing market conditions.

ALM principles require constant review of capital structure, finding the right balance between debt and equity that will minimize cost of capital and maximize shareholders’ wealth. The company should identify its risk tolerance levels, quantify its cost of capital, and make sure it has adequate capital adequacy.

Finally, ALM helps with regulatory compliance and industry standards related to financial reporting. It forces management to implement robust risk frameworks, strengthen internal control and put in place good governance mechanisms to achieve firm transparency and accountability.

The lessons applied in the finance and banking industry can find its applications in nonfinance firms. The rigor of ALM is worth emulating. By leveraging in these practices, nonfinance firms can achieve greater financial stability, resilience, and sustainable growth.

The views expressed herein are his own and do not necessarily reflect the opinion of his office as well as FINEX.

*** Benel Dela Paz Lagua was previously EVP and chief development officer at the Development Bank of the Philippines. He is an active FINEX member and an advocate of risk-based lending for SMEs. Today, he is independent director in progressive banks and in some NGOs. Photos from Pinterest.